Ways to Locate Someone's Mobile Phone Number

How do I find someone’s mobile phone number? Nowadays, with the advancement of technology, finding someone’s mobile phone number has become much …

Read Article

Calculating turnover excluding tax is an essential task for businesses, especially when dealing with consoles. It allows businesses to accurately determine their net sales and assess their financial performance. By excluding tax from the turnover, businesses can focus on the actual revenue generated from the sale of consoles, without the distortion created by tax obligations.

One of the key reasons why businesses need to calculate turnover excluding tax is to have a clear understanding of their profitability. By subtracting tax from the total turnover, businesses can determine their gross margins and assess the profitability of their console sales. This information is crucial for making informed business decisions, such as pricing strategies, cost management, and investment planning.

In addition, calculating turnover excluding tax can help businesses comply with tax regulations. By separating tax from the turnover, businesses can determine the taxable portion of their revenue and ensure accurate reporting of their earnings to tax authorities. This not only ensures compliance but also helps avoid penalties and audits that could result from incorrect or misleading financial information.

Overall, calculating turnover excluding tax is an important aspect of financial management for businesses dealing with consoles. It provides businesses with a clear picture of their net sales, profitability, and tax obligations. By accurately calculating turnover excluding tax, businesses can make informed decisions, comply with tax regulations, and improve their overall financial performance.

Calculating turnover is an important task for businesses as it provides valuable insights into the financial health and performance of the company. Turnover refers to the total sales revenue earned by a business over a specific period of time, typically a year. By accurately calculating turnover, businesses can evaluate their sales performance, determine profit margins, and make informed decisions for future growth and success.

One of the key benefits of calculating turnover is that it allows businesses to assess their sales performance. By comparing turnover figures across different periods, businesses can identify trends, patterns, and areas of improvement. For example, a decrease in turnover may indicate a decline in sales or a need for changes in marketing strategies. On the other hand, an increase in turnover may indicate successful sales initiatives or the introduction of new products or services.

In addition to assessing sales performance, calculating turnover also helps businesses determine their profit margins. Profit margin is the percentage of sales revenue that remains as profit after deducting expenses. By understanding their profit margins, businesses can evaluate their pricing strategies, identify cost-saving opportunities, and make adjustments to maximize profitability.

Furthermore, accurate turnover calculations are essential for tax reporting and compliance. Taxes are typically calculated based on the revenue generated by a business, and turnovers play a crucial role in determining the applicable tax rates. By ensuring accurate turnover calculations, businesses can avoid potential penalties and legal issues associated with incorrect tax reporting.

Overall, understanding the importance of calculating turnover is vital for businesses as it provides insights into sales performance, profit margins, and tax compliance. By regularly monitoring and analyzing turnover figures, businesses can make informed decisions, optimize financial strategies, and strive for long-term sustainability and growth.

Calculating turnover is an essential process for any business as it provides valuable insights into the financial performance and effectiveness of the company. Turnover refers to the total amount of money generated from sales or services within a specific period. By understanding how to calculate turnover, businesses can gain a better understanding of their revenue streams and make informed decisions to improve profitability.

One of the key aspects of turnover calculation is excluding tax. This means that businesses need to calculate their turnover before taking into account any taxes or fees that may be incurred. By excluding tax, businesses can analyze their revenue in a more accurate and meaningful way, focusing on the actual sales and services provided rather than the additional costs associated with taxation.

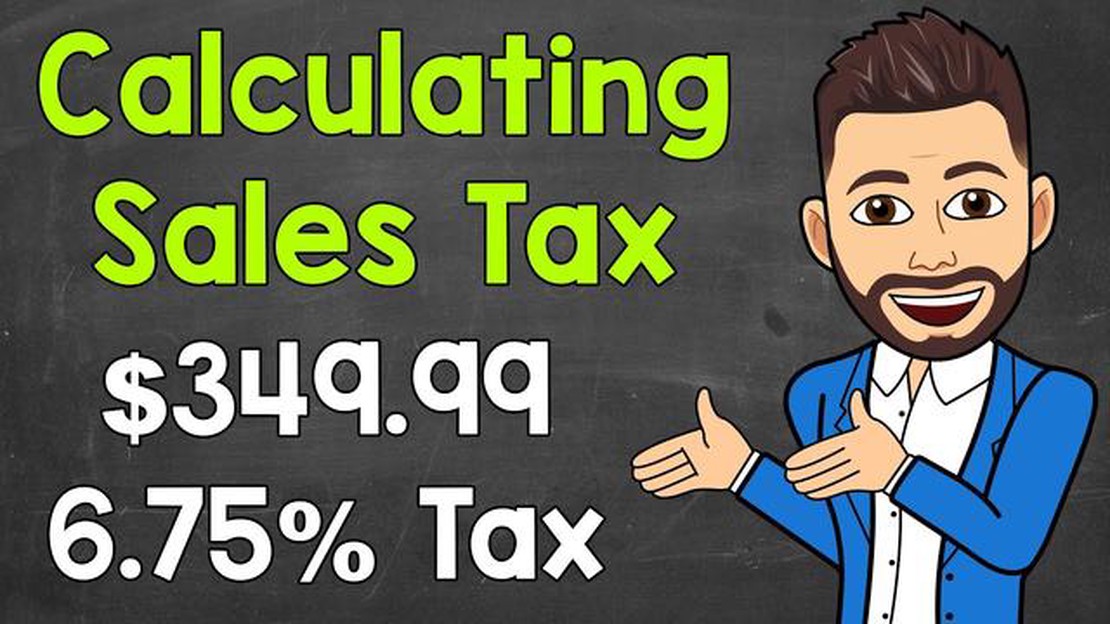

There are various methods businesses can use to calculate turnover excluding tax. One common approach is to deduct the sales tax or value-added tax (VAT) from the total sales revenue. This allows businesses to determine the net sales figure, which is the amount of revenue generated from sales after excluding the tax component.

Another method is to track and record sales receipts or invoices that explicitly state the sales amount before tax. By maintaining accurate records of sales transactions, businesses can easily calculate turnover by summing up the pre-tax sales amounts for a given period.

It is important for businesses to regularly calculate turnover excluding tax to monitor their financial performance. This information can be used to assess the effectiveness of marketing strategies, identify areas of improvement, and make informed decisions regarding pricing, product offerings, and operational efficiency.

Read Also: What are Bao Er's desires in Genshin Impact?

Overall, turnover calculation is a critical process for businesses to evaluate their financial performance. By excluding tax and accurately calculating turnover, businesses can gain valuable insights into their revenue streams and make strategic decisions to drive growth and profitability.

Calculating turnover excluding tax is an essential task for businesses in order to gain a clear understanding of their financial performance. Tax exclusions play a significant role in this calculation, as they help businesses accurately determine the net revenue generated from sales.

Tax exclusions refer to certain items or expenses that are not subject to taxation. These exclusions can vary depending on the tax regulations of a particular country or jurisdiction. Typically, they include items such as sales returns, allowances, and discounts, which reduce the overall taxable revenue.

When calculating turnover excluding tax, it is important to identify and separate these tax exclusions from the total revenue. This can be achieved by maintaining accurate records of sales returns, allowances, and discounts. By deducting these exclusions from the total revenue, businesses can determine the net turnover.

In addition to sales returns, allowances, and discounts, businesses may also need to consider other tax exclusions such as sales of exempted goods or services, export sales, and certain intercompany transactions. These exclusions further impact the turnover calculation by reducing the overall taxable revenue.

To ensure accurate turnover calculation, businesses should establish proper accounting procedures and systems that track and record all tax exclusions. This can be achieved through the use of accounting software or regular audits conducted by experienced professionals. By accurately calculating turnover excluding tax, businesses can make informed financial decisions and assess their financial performance accurately.

Read Also: Addressing the Human Crash in Detroit: Strategies for Recovery

Examples of Tax Exclusions

| Tax Exclusion | Description |

|---|---|

| Sales Returns | Items returned by customers and refunded |

| Allowances | Discounts given to customers for various reasons |

| Sales of Exempted Goods | Goods that are not subject to sales tax |

| Export Sales | Sales made to customers outside the country |

By understanding tax exclusions and their impact on turnover calculation, businesses can accurately assess their financial performance and make informed decisions for future growth and development.

Calculating turnover excluding tax is a crucial step in determining the true profitability of a business. By excluding tax from the turnover, businesses are able to get a clearer picture of their net profit margins and make informed decisions to increase profitability.

There are several strategies that businesses can implement to effectively exclude tax from their turnover and maximize their profitability:

In conclusion, implementing turnover exclusion strategies is essential for businesses looking to increase their profitability. By reducing their taxable turnover through strategies such as tax-exempt sales, optimizing expense claims, utilizing tax incentives, implementing a comprehensive tax planning strategy, and using accounting software, businesses can improve their net profit margins and ultimately achieve greater financial success.

Turnover excluding tax is the total revenue generated by a business before the deduction of any taxes.

Calculating turnover excluding tax is important because it provides businesses with a clear understanding of their financial performance and helps them make informed decisions about pricing, expenses, and profitability.

To calculate turnover excluding tax, you simply add up all the revenue generated by the business during a specific period, without including any taxes or other deductions in the calculation.

Some examples of taxes that should be excluded when calculating turnover are sales tax, value-added tax (VAT), goods and services tax (GST), and any other taxes levied on the purchase or sale of goods or services.

Yes, turnover excluding tax can be negative if the business has more expenses than revenue during a specific period. This is typically the case when a business is facing financial difficulties or experiencing a loss.

No, turnover excluding tax is not the same as gross revenue. Gross revenue includes all of the income generated by a business, including taxes, while turnover excluding tax only includes the revenue generated before the deduction of any taxes.

Some common challenges businesses face when calculating turnover excluding tax include accurately tracking and categorizing revenue, ensuring all sources of income are accounted for, and understanding which taxes should be excluded from the calculation.

How do I find someone’s mobile phone number? Nowadays, with the advancement of technology, finding someone’s mobile phone number has become much …

Read ArticleIs Battlefield 1 or 5 better? Battlefield 1 and Battlefield 5 are two highly popular first-person shooter games in the Battlefield series. Both games …

Read ArticleHow do I ban someone from TikTok? If you’re a TikTok user and you’ve encountered someone who is violating the platform’s community guidelines, you may …

Read ArticleHow do I recharge my Lycamobile UK? Looking to recharge your Lycamobile UK? We’ve got you covered with quick and easy steps to keep you connected! …

Read ArticleWill there be a Cirque du Freak 2 movie? Rumors about a potential sequel to the popular movie “Cirque du Freak: The Vampire’s Assistant” have been …

Read ArticleWhat is the rarest Pokemon in Omega Ruby? Are you an avid Pokemon fan? Do you spend hours exploring the vast world of Omega Ruby, searching for the …

Read Article