Where to Find Dandelions in Genshin Impact: A Comprehensive Guide

Where are dandelions in Genshin Impact? If you’re playing Genshin Impact and looking to collect Dandelions, you’ve come to the right place. Dandelions …

Read Article

When it comes to investing in the stock market, understanding key metrics is essential for making informed decisions. One such metric that investors often rely on is the average stock formula. This formula allows investors to gauge the average value of a stock over a given period of time.

The average stock formula is a relatively simple mathematical calculation used to determine the average price of a stock over a specific time frame. By taking the sum of the stock prices over the given time period and dividing it by the number of data points, investors are able to quickly assess the average price of a stock.

This metric can be particularly useful for investors as it provides insight into the overall trend of a stock’s performance. By comparing the average price to the current price of a stock, investors can determine whether the stock is currently undervalued or overvalued.

Additionally, the average stock formula can be used to analyze the volatility of a stock. By calculating the average price over shorter periods of time, investors can gain insight into how volatile a stock may be. Stocks with higher levels of volatility may present greater risk, but also potentially higher reward.

In summary, the average stock formula is a key metric that investors can utilize to gain insight into a stock’s performance. By assessing the average price over a given time frame, investors can determine the overall trend and volatility of a stock, helping them make more informed investment decisions.

The average stock formula is a fundamental metric that investors use to gauge the overall performance of a stock. It provides valuable insights into the average price movement of a stock over a specific period of time, which is essential for making informed investment decisions.

Calculating the average stock price involves adding up the closing prices of a stock over a given period and dividing it by the number of trading days. This formula helps investors determine the average cost of buying or selling shares during that time frame.

Investors rely on the average stock formula to assess the long-term trend and volatility of a stock’s price. By analyzing the average stock price, investors can identify if a stock has been consistently increasing, decreasing, or experiencing significant fluctuations.

The average stock formula is particularly useful for comparing a stock’s performance against its historical data or benchmark indices. By evaluating the average stock price, investors can determine if a stock is outperforming or underperforming the market average.

Furthermore, the average stock formula can be used to identify potential buying or selling opportunities. If the current stock price deviates significantly from the average stock price, it may indicate a possible trend reversal or a buying/selling signal for investors.

Overall, understanding the average stock formula is crucial for investors looking to measure the performance and volatility of a stock. By analyzing the average stock price, investors can make more informed decisions, identify trends, and seize potential opportunities in the market.

The average stock formula is a vital metric for investors as it provides valuable insights into the performance and stability of a stock. By calculating and analyzing the average stock price, investors can make informed decisions regarding their investments.

One of the key reasons why the average stock formula is important in investing is that it helps investors understand the historical price movements of a stock. By calculating the average stock price over a certain period of time, such as a week, month, or year, investors can identify trends and patterns in the stock’s price behavior. This information can be used to predict future movements and make profitable investment decisions.

Additionally, the average stock formula can be used as a benchmark to compare the performance of different stocks. By calculating and comparing the average stock prices of multiple stocks, investors can determine which stocks are performing better or worse than the market average. This can help investors identify opportunities for diversification and maximize their returns.

Moreover, the average stock formula is crucial in assessing the volatility and risk associated with a particular stock. By calculating the average stock price and comparing it to the current stock price, investors can evaluate the stability and potential fluctuations in the stock’s value. This information is essential for managing risk and determining an appropriate investment strategy.

In conclusion, the average stock formula plays a crucial role in investing as it provides important information about the historical performance, benchmarking, and risk assessment of a stock. By utilizing this formula, investors can make informed decisions, mitigate risks, and maximize their chances of financial success.

Calculating the average stock is an important metric for investors to understand and analyze their investment performance. The average stock is a measure of the average value of a stock over a specific period of time, usually calculated based on the closing prices of the stock.

Read Also: What is the highest prestige in Cold War?

To calculate the average stock, you need to gather the closing prices of the stock for the desired time period. Once you have the closing prices, you can add them together and divide by the number of closing prices to get the average stock price.

One way to visualize the average stock is to create a line graph with the time period on the x-axis and the stock prices on the y-axis. This can give investors a better understanding of the trends and fluctuations in the stock price over time.

The average stock can be used to compare the performance of different stocks or to track the performance of a specific stock over time. Investors can use this metric to assess the volatility of a stock and make informed decisions about buying or selling.

It’s important to note that the average stock is just one metric and should not be the sole factor in investment decisions. Investors should consider other factors such as market trends, company financials, and industry analysis to make well-informed investment decisions.

The average stock value is an important metric for investors because it provides insights into the overall performance of a company’s stock over a specific period of time. It is calculated by taking the sum of the stock values at different points in time and dividing it by the number of data points.

An increasing average stock value indicates that the stock is on an upward trend and is generally considered a positive sign. It suggests that investors have confidence in the company’s future prospects and are willing to pay more for its shares.

Read Also: Counting the Total Number of Moonchase Charms

On the other hand, a decreasing average stock value suggests that the stock is on a downward trend and may indicate a lack of investor confidence. Investors may be selling their shares, causing the stock price to decline.

It’s important to note that the average stock value should not be used as the sole basis for investment decisions. Other fundamental and technical analysis tools should be considered to get a more comprehensive view of the company’s financial health and market trends.

Furthermore, the average stock value should be interpreted in the context of the company’s industry and the overall market conditions. A stock may have a lower average value compared to its peers in a particular industry, but if the industry as a whole is performing poorly, it may not be a cause for concern.

Ultimately, investors should use the average stock value as one of many indicators when making investment decisions. It provides a snapshot of the stock’s performance over a specific period of time, but other factors should be taken into account for a more accurate assessment of a company’s stock value.

When it comes to making investment decisions, understanding the average stock formula can be a crucial tool for investors. By calculating the average stock price over a certain period of time, investors can gain insights into the overall performance of a stock and make informed decisions based on these calculations.

For example, let’s say an investor is considering purchasing shares of a particular company. By using the average stock formula, they can calculate the average price of the stock over a specified period, such as the past year. This calculation allows them to see if the stock has been consistently increasing or decreasing in value over time, which can help them determine whether it is a good investment.

Another example of using the average stock formula is in comparing different stocks within the same industry. By calculating the average stock prices of competing companies, investors can identify which stock is performing the best relative to its peers. This information allows them to make more informed decisions about which stock to invest in, as they can see which one has a stronger track record of success.

In addition to analyzing historical data, the average stock formula can also be used to make projections about future stock prices. By calculating the average stock price over a certain period and using other financial indicators, investors can estimate the future performance of a stock. This can be particularly useful for identifying potential trends and making predictions about whether a stock is likely to increase or decrease in value in the future.

In summary, the average stock formula is a key metric that can help investors make more informed investment decisions. Whether it’s analyzing historical data, comparing stocks within an industry, or making projections about future performance, this formula provides valuable insights into the overall performance of a stock. By using the average stock formula, investors can increase their chances of making successful investments and achieving their financial goals.

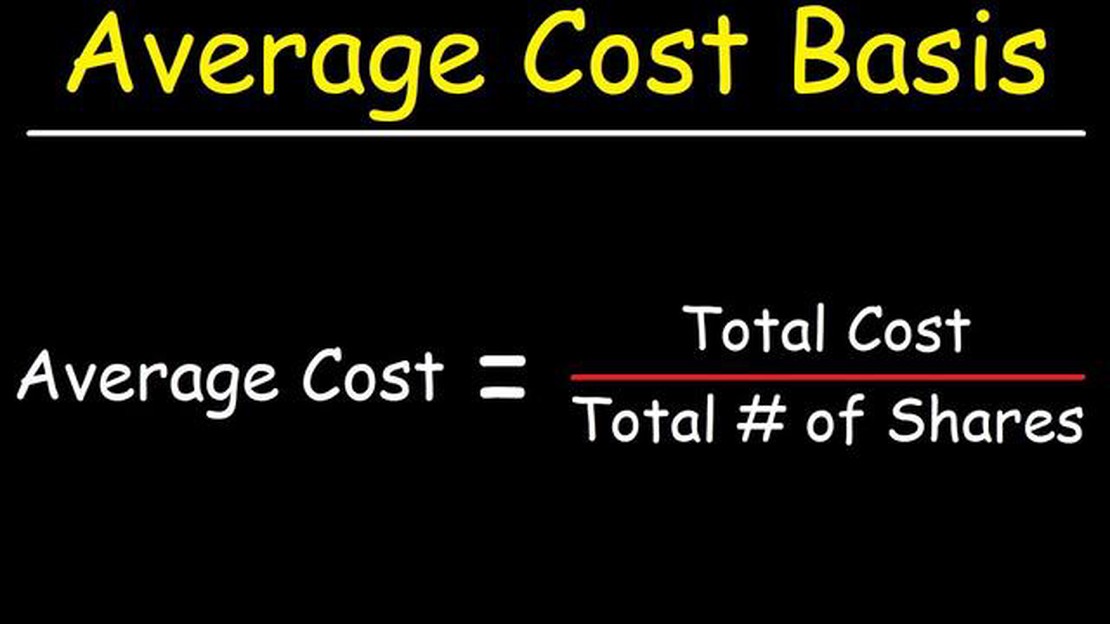

The average stock formula is a key metric used by investors to calculate the average price at which they have purchased a particular stock. It is calculated by dividing the total amount invested in the stock by the total number of shares purchased.

The average stock formula is important for investors because it provides them with a measure of the average cost of acquiring a particular stock. This information can be used to evaluate the profitability of their investment and make informed decisions about buying or selling the stock.

To calculate the average stock price, you need to add up the total amount of money you have invested in a particular stock and divide it by the total number of shares you have purchased. This will give you the average price at which you have acquired the stock.

The average stock price is significant because it provides investors with a benchmark for evaluating the performance of their investment. By comparing the current market price of the stock to the average price, investors can determine whether they are making a profit or a loss on their investment.

No, the average stock price cannot be used to predict future stock prices. The average stock price is a historical measure that reflects the average price at which an investor has acquired a particular stock. It does not take into account future market conditions or events that may impact the price of the stock.

No, the average stock price is not the same as the current market price. The average stock price is a measure of the average price at which an investor has acquired a particular stock, while the current market price is the price at which the stock is currently trading in the market.

Where are dandelions in Genshin Impact? If you’re playing Genshin Impact and looking to collect Dandelions, you’ve come to the right place. Dandelions …

Read ArticleWhich vendors have the most caps New Vegas? Playing Fallout: New Vegas can be a challenging experience, especially when it comes to managing your …

Read ArticleAre they making NBA playgrounds 3? Rumors have been swirling about the possibility of a third installment in the popular basketball arcade game, NBA …

Read ArticleDoes Brooke cheat on Lucas? One of the most popular and beloved couples on the hit television show “One Tree Hill” is undoubtedly Brooke Davis and …

Read ArticleHow do you cheat on SimCity iPhone? SimCity for iPhone is a popular simulation game that allows players to build and manage their own virtual city. …

Read ArticleWhere do you find neighbors in Sims FreePlay? The Sims FreePlay is a popular simulation game where players can create their own virtual world and …

Read Article