Is Wreck It Ralph a real game?

Is Wreck It Ralph an actual video game or just a fictional creation? Wreck It Ralph, the beloved animated film released in 2012, tells the story of a …

Read Article

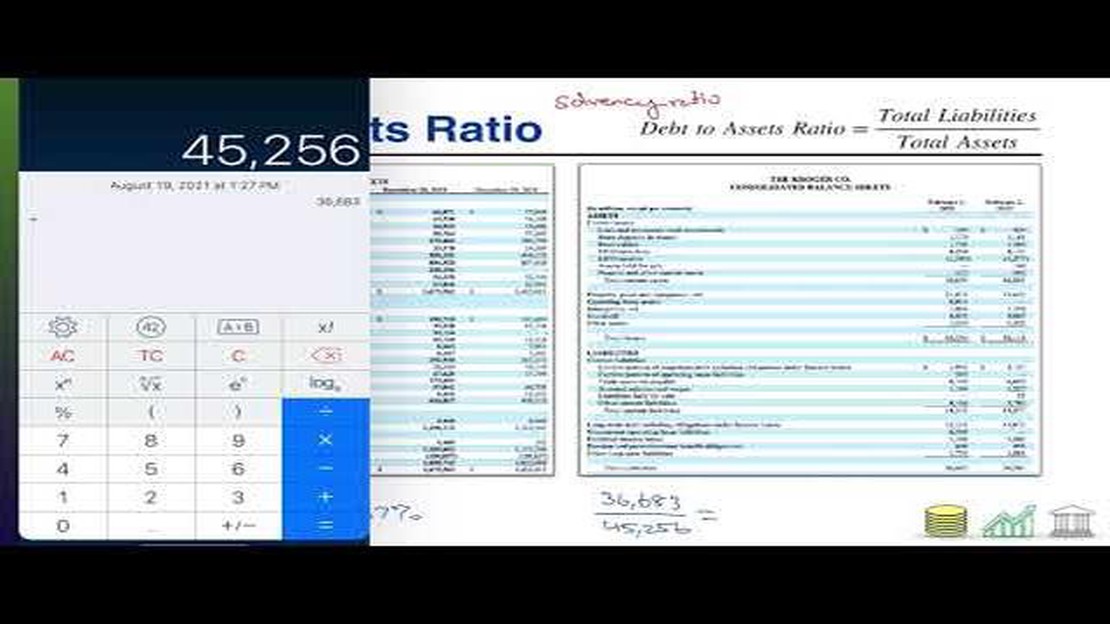

The Total Liabilities to Total Assets ratio is a financial metric that helps investors and analysts assess a company’s financial health and risk. It provides insights into the percentage of a company’s total assets that are financed by its total liabilities. This ratio is an important tool for evaluating a company’s solvency, as it indicates the company’s ability to meet its financial obligations and repay its debts.

Calculating the Total Liabilities to Total Assets ratio is quite straightforward. It is calculated by dividing a company’s total liabilities by its total assets. Total liabilities include both current and long-term liabilities, such as loans, bonds, and other debts, while total assets encompass all of a company’s resources, including cash, inventory, property, and equipment. The resulting ratio is expressed as a percentage.

A high Total Liabilities to Total Assets ratio indicates that a company relies heavily on debt to finance its operations and investments. This could suggest that the company is highly leveraged and may be at greater risk of defaulting on its obligations. On the other hand, a low ratio suggests a lower risk of insolvency, as the company has a higher proportion of assets to cover its liabilities.

While the Total Liabilities to Total Assets ratio is a useful tool for assessing a company’s financial health, it is important to interpret it in the context of the industry and the company’s specific circumstances. Different industries have different levels of acceptable leverage, and comparing the ratio of a company to its industry peers can provide valuable insights. Additionally, trends in the ratio over time can also be informative, as it can highlight changes in a company’s financial structure and risk profile.

The total liabilities to total assets ratio is a financial metric used to measure the proportion of a company’s liabilities to its total assets. It provides insight into the risk associated with a company’s debt levels and its ability to repay its obligations.

This ratio is calculated by dividing the company’s total liabilities by its total assets. It is expressed as a percentage or a decimal. A higher ratio indicates that the company relies heavily on debt to finance its operations, which can increase its financial risk.

Investors and lenders use the total liabilities to total assets ratio to assess a company’s financial health and solvency. It helps them evaluate the company’s ability to manage its debt and meet its obligations. A higher ratio may indicate a higher risk of default, while a lower ratio suggests a more stable financial position.

In addition to evaluating a company’s current financial situation, the total liabilities to total assets ratio can be used to compare the financial performance of different companies within the same industry. It can also be tracked over time to monitor changes in a company’s debt levels and financial risk.

It’s important to note that the interpretation of the total liabilities to total assets ratio can vary depending on the industry. Some industries, such as manufacturing or construction, may naturally have higher debt levels due to the need for capital-intensive operations. Therefore, it is crucial to consider industry benchmarks and analyze the ratio within the context of the specific industry.

To summarize, the total liabilities to total assets ratio is a valuable metric for assessing a company’s financial risk and solvency. It provides insight into a company’s reliance on debt and its ability to meet its obligations. Investors and lenders can use this ratio to make informed decisions about investing or lending to a company, while also considering industry benchmarks and trends.

The Total Liabilities to Total Assets Ratio is a financial metric used to assess a company’s financial health and leverage. It helps evaluate the extent to which a company’s assets are financed by debt. This ratio provides insight into a company’s ability to meet its financial obligations and its overall level of risk.

The formula for calculating the Total Liabilities to Total Assets Ratio is:

Total Liabilities to Total Assets Ratio = Total Liabilities / Total Assets

A ratio greater than 1 indicates that a company has more liabilities than assets, which may be a sign of financial distress or high risk. Conversely, a ratio less than 1 suggests that a company has more assets than liabilities, indicating a stronger financial position.

Analysts and investors use this ratio to evaluate a company’s solvency and determine its ability to repay its debts. A higher ratio may indicate that a company relies heavily on debt to finance its operations, while a lower ratio suggests that a company has a strong balance sheet and is less reliant on debt.

It’s important to note that this ratio should be interpreted in the context of the industry in which the company operates. Different industries have different norms and standards for acceptable levels of leverage and risk.

Overall, the Total Liabilities to Total Assets Ratio provides valuable insight into a company’s financial health and its ability to manage its debt obligations. By analyzing this ratio, stakeholders can make informed decisions about the company’s future prospects and risk tolerance.

The total liabilities to total assets ratio is a key financial metric that provides valuable insight into the financial health and stability of gaming companies. It measures the proportion of a company’s total liabilities to its total assets, indicating how much of the company’s assets are financed by debt. This ratio is particularly important in the gaming industry, where companies often have significant financial obligations and face unique risk factors.

Analyze…

One of the primary reasons why the total liabilities to total assets ratio is important in the gaming industry is that it helps assess the overall riskiness of a company. A higher ratio indicates a higher degree of leverage and financial risk, as a larger portion of the company’s assets are funded by debt. This can make the company more vulnerable to economic downturns or changes in consumer spending habits, as it may struggle to meet its debt obligations.

Moreover…

In the gaming industry, where companies often have significant investment in intangible assets such as intellectual property, the total liabilities to total assets ratio becomes even more important. Intangible assets are often difficult to value and can be at risk of impairment. A higher ratio suggests that the company may have a larger proportion of debt relative to its tangible assets, which could be a cause for concern if the company faces challenges in monetizing its intangible assets.

In addition…

The total liabilities to total assets ratio also plays a crucial role in determining a gaming company’s ability to raise additional capital. Investors, lenders, and other stakeholders use this ratio as a measure of a company’s creditworthiness and financial stability. A higher ratio may make it more challenging for a gaming company to secure new financing, as lenders and investors may perceive a higher level of risk associated with the company’s financial position.

Overall, the total liabilities to total assets ratio is an important indicator of a gaming company’s financial health and risk profile. It helps assess a company’s ability to manage its debt obligations, monetize its assets, and secure future financing. By analyzing this ratio, investors and stakeholders can make informed decisions regarding their involvement with gaming companies and evaluate the potential risks and rewards associated with investing in this industry.

Read Also: Does Game Capture Capture Audio?

The total liabilities to total assets ratio is an important financial metric used to assess the financial health and risk profile of a gaming company. This ratio measures the proportion of a company’s total liabilities to its total assets, providing insight into the level of leverage and financial obligations carried by the company.

Several factors can impact the total liabilities to total assets ratio in the gaming industry. One of the key factors is the level of debt taken on by the company. Gaming companies often require significant capital investments to develop and maintain their gaming platforms, and they may finance these investments through debt issuance. A higher level of debt will increase the company’s liabilities and subsequently raise the total liabilities to total assets ratio.

Read Also: Can you play 2 player on Plants vs Zombies gw2?

The composition of a gaming company’s assets can also influence the ratio. For example, if a large portion of the company’s assets is made up of intangible assets such as intellectual property or licenses, which can be difficult to value and monetize, the ratio may be higher. On the other hand, if a company has a high proportion of tangible assets like property, equipment, or inventory, which can be easily sold or liquidated, the ratio may be lower.

Another factor that can affect the ratio is the size and structure of a gaming company’s operations. Companies that operate in multiple jurisdictions or have a diverse range of gaming products may have different regulatory requirements and legal obligations, which can impact their liabilities. Additionally, companies that engage in mergers, acquisitions, or divestitures may experience fluctuations in their total liabilities to total assets ratio as the composition of their assets and liabilities changes.

Furthermore, the competitive dynamics of the gaming industry can impact the ratio. Gaming companies that face intense competition may need to invest more heavily in marketing, research and development, or acquisitions to stay ahead, resulting in higher liabilities and a higher ratio. On the other hand, companies that enjoy a dominant market position or have a unique gaming offering may be able to maintain a lower ratio as they generate higher profits and cash flow.

Overall, the total liabilities to total assets ratio in the gaming industry is influenced by a combination of factors including debt levels, asset composition, operational structure, and competitive dynamics. It is essential for investors, analysts, and stakeholders to consider these factors when evaluating the financial health and risk profile of gaming companies.

The total liabilities to total assets ratio is a financial metric that helps investors and analysts understand the proportion of a company’s liabilities compared to its total assets. This ratio provides insight into a company’s leverage and financial strength, as it illustrates the extent to which a company’s assets are financed by debt.

To calculate the total liabilities to total assets ratio, you need to know the value of a company’s total liabilities and total assets. Total liabilities include both short-term and long-term obligations, such as loans, accounts payable, and accrued expenses. Total assets include all of a company’s resources, including cash, inventory, property, and equipment.

The formula to calculate the total liabilities to total assets ratio is:

Total Liabilities to Total Assets Ratio = Total Liabilities / Total Assets

For example, if a company has total liabilities of $500,000 and total assets of $1,000,000, the total liabilities to total assets ratio would be 0.5. This means that half of the company’s assets are financed by liabilities.

It’s important to note that the interpretation of the total liabilities to total assets ratio may vary depending on the industry and company. A higher ratio indicates a greater reliance on debt financing, which can increase financial risk. Conversely, a lower ratio indicates a more conservative capital structure and a stronger financial position.

Investors and analysts often compare the total liabilities to total assets ratio of a company to its industry peers or historical data to assess its financial health and risk profile. By analyzing this ratio over time, they can identify trends and make informed investment decisions.

In conclusion, the total liabilities to total assets ratio is a useful metric for evaluating a company’s leverage and financial strength. By understanding how to calculate and interpret this ratio, investors and analysts can gain valuable insights into a company’s risk profile and make informed investment decisions.

The Total Liabilities to Total Assets (TLTA) ratio is an important financial metric that provides insight into the financial health and risk profile of gaming companies. This ratio is calculated by dividing the total liabilities of a company by its total assets, and it is used to assess the extent to which a company’s assets are financed by debt.

A high TLTA ratio indicates that a gaming company has a significant amount of debt relative to its assets. This can be a cause for concern as it suggests that the company may be more vulnerable to financial instability and default. High debt levels can limit a company’s ability to invest in new games or technology, potentially hindering its competitiveness in the ever-evolving gaming industry.

On the other hand, a low TLTA ratio indicates that a gaming company has a smaller amount of debt compared to its assets. This can be a positive signal as it suggests that the company has a stronger financial position and is less reliant on borrowing to finance its operations. A lower TLTA ratio can also provide the company with more flexibility and financial freedom to pursue growth opportunities and adapt to changing market conditions.

When analyzing the TLTA ratio of gaming companies, it is important to consider the industry norms and the company’s specific circumstances. Different types of gaming companies might have different risk tolerances and capital structures, which can influence the optimal level of debt for the company. Additionally, changes in the TLTA ratio over time can provide insights into the company’s financial management practices and its ability to effectively manage its debt.

In summary, the TLTA ratio is a valuable metric for assessing the financial health and risk profile of gaming companies. It provides insights into the extent to which a company’s assets are financed by debt and can help investors and stakeholders make informed decisions. Understanding the implications of the TLTA ratio can assist in evaluating the financial stability, growth potential, and competitiveness of gaming companies in an industry that is constantly evolving.

The Total Liabilities to Total Assets Ratio is a financial ratio that measures the proportion of a company’s total liabilities to its total assets. It is used to assess the level of risk and leverage of a company.

The Total Liabilities to Total Assets Ratio is calculated by dividing the total liabilities of a company by its total assets, and then multiplying the result by 100 to express it as a percentage.

A high Total Liabilities to Total Assets Ratio signifies that a company has a higher proportion of debt in relation to its assets. This indicates that the company may have a higher level of financial risk and may be more leveraged.

A low Total Liabilities to Total Assets Ratio implies that a company has a lower proportion of debt in relation to its assets. This indicates that the company may have a lower level of financial risk and may be less leveraged.

The Total Liabilities to Total Assets Ratio is useful for investors as it provides insights into a company’s financial health and risk level. Investors can use this ratio to assess the level of debt and leverage of a company before making investment decisions.

Some limitations of the Total Liabilities to Total Assets Ratio include the fact that it does not take into account the quality of the assets or the ability of the company to generate profits. Additionally, it may not be comparable across industries or companies of different sizes.

Is Wreck It Ralph an actual video game or just a fictional creation? Wreck It Ralph, the beloved animated film released in 2012, tells the story of a …

Read ArticleCan a woman lift 100 pounds? When it comes to physical strength and power, there has been a long-standing stereotype that men are inherently stronger …

Read ArticleIs it worth it to sell games at GameStop? Are you wondering whether selling your used games at GameStop is worth it? We’ve got you covered with a …

Read ArticleWhat’s the best gun in Cold War zombies? The release of Call of Duty: Black Ops Cold War has brought with it an intense wave of zombies, and players …

Read ArticleWhy is there a bonus in basketball? Basketball is a popular sport that has captured the hearts of millions around the world. Fans and players alike …

Read ArticleHow do I trigger Ella Musk quest? Genshin Impact is a popular open-world action role-playing game that offers a vast world full of quests and …

Read Article