6 Tips to Boost Agility for Saradomin God Wars

Can you boost agility for saradomin god wars? If you’re an avid player of the popular MMORPG Old School RuneScape, you’re probably well aware of the …

Read Article

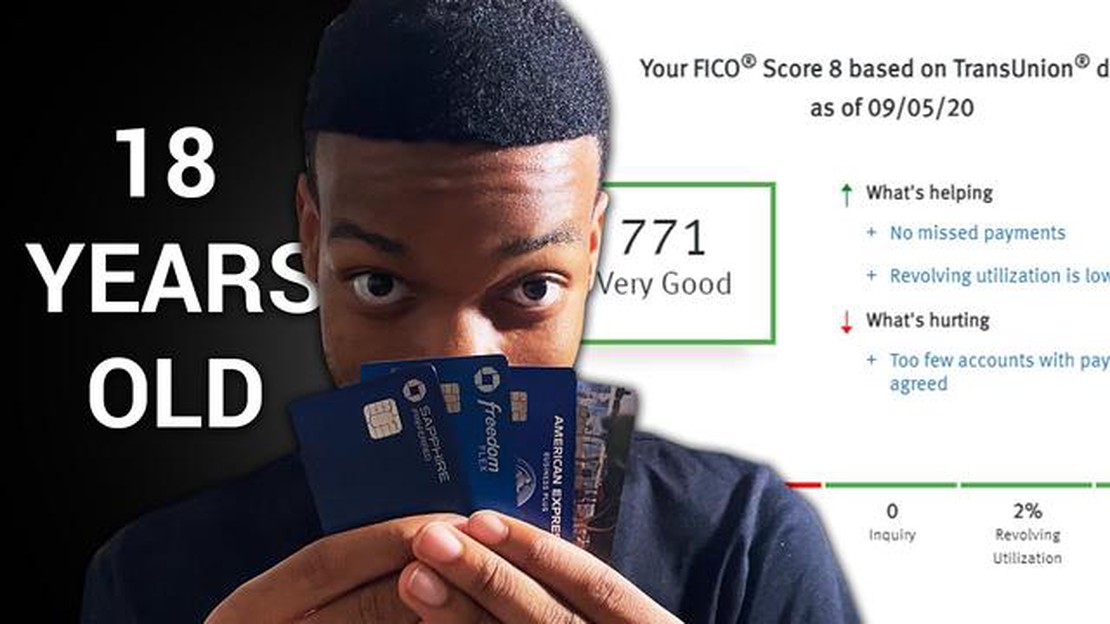

When it comes to credit scores, age can play a significant role. As young adults enter the world of financial independence, it’s crucial to understand the average credit scores for 18-year-olds and the factors that can influence them. A credit score is a three-digit number that represents an individual’s creditworthiness, indicating their ability to repay debts and manage financial responsibilities.

At 18 years old, most individuals are just beginning their financial journey, which means they may not have had sufficient time to establish a credit history. This lack of credit history can make it challenging for lenders and creditors to assess their creditworthiness. Therefore, the average credit score for 18-year-olds tends to be lower compared to older age groups, such as those in their 30s or 40s.

It’s important to note that the average credit score for 18-year-olds can vary depending on several factors. One such factor is whether or not the individual has opened their own credit accounts, such as a credit card or a small loan. Those who have taken on some form of credit and have made consistent, timely payments may have a higher credit score compared to those who have no credit history at all.

Additionally, other factors such as income, employment history, and financial responsibilities can also impact an 18-year-old’s credit score. For example, if an 18-year-old has a stable job, a good income, and minimal financial obligations, they may be viewed as less of a credit risk and may have a higher credit score.

A credit score is a numerical value that represents a person’s creditworthiness. It is a measure of how likely an individual is to repay their debts based on their past financial behavior. Credit scores are used by lenders, landlords, and other entities to assess the risk of extending credit or entering into a financial agreement with an individual.

Credit scores typically range from 300 to 850, with higher scores indicating a lower credit risk. A higher credit score can make it easier for individuals to qualify for loans and obtain favorable interest rates. Conversely, a lower credit score can make it more difficult to access credit or may result in higher interest rates.

Credit scores are determined by various factors, including payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries. Payment history accounts for the largest portion of a credit score, emphasizing the importance of making timely payments on all debts. High credit utilization, or utilizing a large percentage of available credit, can negatively impact a credit score.

It is crucial for individuals to monitor their credit scores regularly and understand the factors that contribute to their scores. By maintaining a good credit score, individuals can improve their financial standing and increase their chances of obtaining credit on favorable terms.

A credit score is a three-digit number that represents an individual’s creditworthiness. It is a reflection of their financial history, including their ability to repay debts and manage credit responsibly. Credit scores play a crucial role in a person’s financial life, impacting their ability to obtain loans, secure favorable interest rates, and even rent an apartment.

Having a good credit score is important because it demonstrates to lenders and financial institutions that you are a reliable borrower. A higher credit score indicates that you are more likely to repay your loans on time and in full. This can result in lower interest rates and better terms on credit cards, mortgages, and car loans. On the other hand, a low credit score can make it difficult to get approved for loans or credit cards, and it may result in higher interest rates and less favorable loan terms.

Furthermore, credit scores are not only important for borrowing money. They can also impact other aspects of your life, such as renting an apartment. Landlords often check the credit scores of potential tenants to determine their financial responsibility and reliability. A low credit score may cause landlords to reject your rental application or require a larger security deposit.

To maintain a good credit score, it is essential to manage your credit responsibly. This includes paying bills on time, keeping credit card balances low, and avoiding excessive debt. Regularly checking your credit report for errors and fraudulent activity is also important to ensure that your credit score accurately reflects your financial history.

In summary, credit scores are a crucial aspect of personal finance. They impact your ability to borrow money, secure favorable terms, and even rent an apartment. Maintaining a good credit score requires responsible financial management and regular monitoring of your credit report.

Read Also: Unleash the Power: Understanding the Wii Reset Button

As young adults transition into the adult world, many are curious about their financial health, including their credit score. Credit scores are important as they determine an individual’s creditworthiness and can impact their ability to secure loans, mortgages, and credit cards.

For 18-year-olds, establishing credit is a new and important step in their financial journey. While they may not have a long credit history, there are still ways for them to have an average credit score.

On average, the credit scores for 18-year-olds tend to be lower compared to older age groups. This is mainly because they haven’t had enough time to build a solid credit history. Their limited financial experience and lack of credit accounts can result in lower scores.

However, taking proactive steps to build credit can help 18-year-olds improve their scores over time. This includes opening a credit card or becoming an authorized user on a parent’s credit card account. Making timely payments and keeping credit utilization low are key factors in improving average credit scores.

It’s also important for 18-year-olds to understand that their credit score is not solely determined by their financial actions. Other factors, such as their employment history, income, and the types of credit they have, can also impact their average credit score.

Therefore, it is crucial for young adults to practice responsible financial habits and make informed decisions when it comes to credit. This can help them establish a solid credit foundation and increase their average credit score over time.

Read Also: How to Unlock the Poetry Exchange Quest in Genshin Impact

Payment History: One of the most important factors that affects credit scores is payment history. This includes whether or not payments are made on time and if any payments have been missed or defaulted on. Late payments or a history of missed payments can have a negative impact on a credit score.

Credit Utilization: Credit utilization refers to the amount of credit a person is using compared to their available credit. A high credit utilization ratio, meaning a large amount of credit being used, can negatively affect a credit score. It is generally recommended to keep credit utilization below 30% to maintain a good credit score.

Length of Credit History: The length of a person’s credit history also plays a role in determining their credit score. A longer credit history can be seen as more favorable, as it provides a track record of responsible credit use. Individuals who are just starting out with credit may have a lower credit score simply due to their limited credit history.

Types of Credit: The types of credit a person has can impact their credit score. Having a mix of different types of credit, such as credit cards, installment loans, and mortgages, can be beneficial. However, having too many accounts or a heavy reliance on one type of credit can have a negative impact.

Recent Credit Inquiries: The number of recent credit inquiries can also affect a credit score. When an individual applies for new credit, such as a credit card or loan, a hard inquiry is typically made on their credit report. Having too many recent credit inquiries can be seen as a red flag to lenders, as it may indicate financial instability or a reliance on credit.

Public Records: Public records, such as bankruptcies, tax liens, or judgments, can have a significant impact on a person’s credit score. These negative marks stay on a credit report for several years and can drastically lower a credit score. It is important to avoid these types of negative public records to maintain a good credit score.

In conclusion, there are several factors that can affect a person’s credit score. Maintaining a positive payment history, managing credit utilization, establishing a longer credit history, having a mix of credit types, minimizing recent credit inquiries, and avoiding negative public records are all important in maintaining a good credit score.

A credit score is a three-digit number that reflects a person’s creditworthiness. It is calculated based on the individual’s credit history and is used by lenders to assess the risk of lending money to that person.

Having a good credit score is important because it can affect a person’s ability to obtain loans, credit cards, and other forms of credit. A higher credit score typically means better loan terms, lower interest rates, and more favorable credit options.

The average credit score for 18-year-olds is typically lower than the overall average credit score for adults. This is because they have limited credit history or no credit history at all. The average credit score for 18-year-olds can vary, but it is generally around 630 to 650.

An 18-year-old can establish a good credit score by taking steps to build credit responsibly. This can include getting a secured credit card, making on-time payments, keeping credit utilization low, and avoiding excessive debt. It is important for young individuals to start building credit early to establish a solid credit history.

There are several factors that can lower an 18-year-old’s credit score. These include missed or late payments, high credit utilization, having a short credit history, applying for too many credit cards or loans, and having a high amount of debt. It is important for young individuals to be aware of these factors and manage their credit responsibly to maintain a good credit score.

Can you boost agility for saradomin god wars? If you’re an avid player of the popular MMORPG Old School RuneScape, you’re probably well aware of the …

Read ArticleCan I use Wii U without GamePad? The Wii U, a popular gaming console developed by Nintendo, was originally released with the GamePad, a unique …

Read ArticleWhat does N Y mean in Gacha life? In the world of Gacha Life, a popular mobile game, players have been buzzing about a new catchphrase that has been …

Read ArticleWhat is Ichigo’s strongest form? The gaming world is buzzing with excitement as the news of Ichigo’s most powerful form has been revealed. Fans of the …

Read ArticleWhy are Halo 5 servers so bad? The Halo franchise has long been revered as one of the most popular and successful gaming series of all time. With its …

Read ArticleWhat is the best catalyst in Genshin Impact? Genshin Impact is a popular action role-playing game developed by miHoYo. It features a vast open world …

Read Article